How Do Mortgage Brokers Rip You Off: When you’re looking to buy a home, one of the most important decisions you’ll make is who you decide to work with to get the best mortgage rates.

Unfortunately, many people don’t fully understand what goes into getting the best rates and end up getting taken advantage of by unscrupulous mortgage brokers. In this article, we’ll take a look at some of the most common ways that mortgage brokers can rip you off and how to avoid them. How Do Mortgage Brokers Rip You Off:

Mortgage Brokers Explained

Mortgage brokers are necessary for anyone looking to buy a home or refinance their current one. They are contracted by lending institutions to find the best loan for their customer and can help navigate the various mortgage options available. However, like in any other professional service industry, there are some unscrupulous brokers out there who will attempt to take advantage of their customers. Here are five ways mortgage brokers can rip you off:

1. Failing to disclose all the important details about your loan. A mortgage broker is not a bank and cannot provide you with the same level of detail about your loan options as a bank can. This means they may not tell you that you could be eligible for a lower interest rate or that you might qualify for a government loan. It’s important to ask questions and get as much information as possible so you make an informed decision.

2. Misleading you into buying a product that isn’t right for you. If you don’t qualify for the product offered by your broker, they may try to sell you another product that is more expensive or has extra terms and conditions that you weren’t aware of. Don’t let them pressure you into making decisions you don’t want to make.

3. Charging high fees. Mortgage brokers are allowed to charge a fee for their services, but it shouldn’t be more than what the bank charges you. They may also try to sell you add-ons, such as insurance or legal services, that you don’t need and will actually end up costing you more money in the long run.

4. Being unwilling to help you if you have questions about your loan or the process. If you have any questions about your loan or the process of buying a home, don’t hesitate to ask your broker. However, if they don’t seem willing to help or offer sound advice, it might be a sign that they’re not legitimate.

5. Failing to keep up with changes in mortgage laws. As the mortgage market has changed over the years, so have the rules and regulations governing it. If there are any changes that could affect your loan – like new regulations on pre-qualification checks – your broker should be aware of them and be able to help you avoid any potential problems. If they can’t keep up with the latest changes, it’s probably a sign that they’re not qualified to help you with your mortgage. How Do Mortgage Brokers Rip You Off:

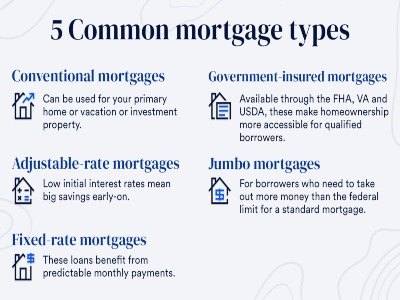

The Different Types of Mortgage Products

Mortgage brokers work hard to get you the best product for your needs. However, not all products are created equal and some can be more expensive than others. Here are three types of mortgage products and what they entail:

1. Single-family mortgage

This is the most common type of mortgage and typically refers to a home loan for a single-family dwelling such as a house or condo. A single-family mortgage typically has lower interest rates than a dual-family mortgage or a multifamily mortgage, but it also comes with higher fees and may require a down payment.

2. Dual-family mortgage

A dual-family mortgage is similar to a single-family mortgage, but it allows for the borrowing of money for two or more families living in the same dwelling. This type of loan typically has lower interest rates than a single-family mortgage, but it also comes with higher fees and requires a larger down payment.

3. Multifamily mortgage

A multifamily mortgage is a loan that is designed to finance the purchase or construction of apartments, condos, or other structures used as housing for more than one family unit. This type of loan usually has a lower interest rate than a dual-family mortgage, but it comes with higher fees and may require a down payment. How Do Mortgage Brokers Rip You Off:

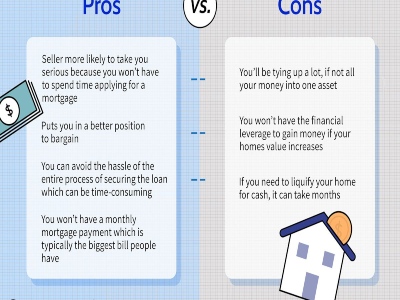

The Pros and Cons of Mortgage Deals

There are pros and cons to each type of mortgage, so it’s important to do your research before making a decision. Here are some things to keep in mind when shopping for a mortgage:

-A fixed-rate mortgage is the simplest and usually offers the lowest interest rates. However, this type of mortgage is often less flexible than other options, so make sure you understand the terms.

-A variable-rate mortgage can change with the interest rate market, which can be risky if you don’t understand the risks. However, if you’re able to lock in an interest rate before you buy a home, this type of mortgage can be a good option.

-A hybrid loan combines features of both fixed and variable-rate mortgages. This type of loan is usually more flexible than either category alone, but it comes with higher interest rates and may have more fees.

-Before you sign any paperwork, make sure you have a good understanding of what you’re getting into. Talk to a qualified lender or consult a financial advisor to get advice on the best option for you. How Do Mortgage Brokers Rip You Off:

How to Shop for a Mortgage

If you’re looking to buy a home, it’s important to do your research and ask plenty of questions. One of the most important factors to consider is the cost of a mortgage. Here are four tips for shopping for a mortgage:

1. Shop around – don’t just take the first quote you receive. Compare different lenders and find one that has a rate that’s affordable for you. You can also use online tools like calculators to get an estimate of your monthly payments.

2. Get pre-approved – this is especially important if you have bad credit or low income. A pre-approval will help determine whether you qualify for the best loan terms available. Be sure to ask about fees and closing costs associated with getting pre-approved.

3. Know your credit score – your credit score is one factor in determining whether you qualify for a mortgage. If you’re not confident about your score, request a free copy from each of the three major credit bureaus. Once you have all three scores, compare them and make any necessary adjustments (such as raising your credit limits).

4. Get advice

When looking to buy a home, you’ll want to be sure to shop around for the best mortgage deal. There are a lot of different mortgage brokers out there, and it can be hard to know which one to choose. This guide will help you find the best mortgage broker for your needs. How Do Mortgage Brokers Rip You Off:

Once you have your budget and interest rate set, it’s time to look at your credit score. A good mortgage broker will work with all types of borrowers, but they may not be able to get you the best deal if your credit score is low.

Finally, consider what type of loan you want. You may want a fixed-rate or adjustable-rate loan. A fixed-rate loan will have a set interest rate throughout the life of the loan, while an adjustable-rate loan has an interest rate that changes over time. How Do Mortgage Brokers Rip You Off:

Once you have all of this information, it’s time to get pre-approved. A pre-approval will show the lender that you’re a qualified borrower, and it may help you get a better interest rate. How Do Mortgage Brokers Rip You Off:

Remember: don’t just take the first mortgage quote you receive. Compare different lenders and find one that has a rate that’s affordable for you. How Do Mortgage Brokers Rip You Off:

How Mortgage Brokers Rip You Off UK

Mortgage brokers are notorious for ripping people off. They are the middlemen between you and the lender, but they can often charge high fees and refuse to give you a good deal. Here are four ways that mortgage brokers can rip you off:

1. Charging excessive application fees.

Many brokers will charge an application fee, even if you don’t end up getting a mortgage from them. This fee can be hundreds of pounds, and it’s usually unnecessary. You can get a better deal from a rival broker who doesn’t charge an application fee.

2. Overcharging for your mortgage advice.

Some brokers will charge you for advice on how to get a good mortgage deal, even if you don’t end up using their services. These costs can amount to hundreds of pounds, and they’re not always necessary. You can get similar advice from independent financial advisors at no cost.

3. Failing to give you the best possible deal.

Some brokers will offer you a bad deal in order to increase their profits. They may refuse to give you a good rate or they may charge high fees for extra services such as mortgage assessment or legal advice. Avoid these rogue brokers by shopping around for a better deal.

4. Misleading you about your mortgage options.

Some brokers will tell you that you only have a few mortgage options available to you, when in fact there are much more available. They may also try to sell you an unsuitable product, such as a high-risk loan or a product with hidden fees. Be sure to get independent advice before making any decisions. How Do Mortgage Brokers Rip You Off:

How Mortgage Brokers Make Money

Mortgage brokers make money by charging fees for their services. They may charge a fixed fee, an origination fee, or a closing fee. They may also charge a rate of interest on a mortgage loan. How Do Mortgage Brokers Rip You Off:

When to Refinance Your Mortgage

Mortgage brokers are experts at finding ways to get you to sign on the dotted line. But before you do, be sure to ask yourself some key questions. Here are four to keep in mind when refinancing:

1) When was your last mortgage payment due?

2) What is your credit score?

3) What is your current interest rate?

4) How much money can you afford to pay each month?

If any of these factors change, be sure to update your broker or mortgage lender. In addition, always consult with a qualified financial advisor before making any major decisions about your money. How Do Mortgage Brokers Rip You Off:

Conclusion

When it comes to mortgages, it’s important to know a few things in order to avoid being ripped off. One of the most common ways that mortgage brokers rip you off is by charging high fees. Not only do these fees often increase the overall cost of your mortgage, but they can also result in higher interest rates down the line. It’s also important to be wary of mortgage lenders who offer low initial interest rates but then tack on hidden costs later on. Always read the fine print and ask questions before signing any documents related to your mortgage! How Do Mortgage Brokers Rip You Off: